SMARTOUTWARD™

Outward Cheques Clearing Solutions

Simplify outward cheque clearing process with automatic data conversion compatible with Indonesian clearing house application (SKNBI Gen.2)

Outgoing cheque clearing, or called outward cheques, is the first part of interbank cheque clearing process. Before the physical cheques are delivered to the clearing house, the cheques’ data needed to be captured to be electronically transmitted to the clearing house.

The electronic transmission of cheque data may require Banks to adjust their Core Banking System to enable the clearing data to be extracted and sent directly to the clearing house. However, CBS (core banking system) adjustment is not only costly, but also requires complicated and complex development.

MICR reading based on its magnetic presence to prevent cheque fraud

Automatic MICR data input into the respective fields

Cheque image scanning in greyscale, B/W, or color, for automatic digital archival & retrieval

Cheque batching & data validation against reference data at the Clearing House’s participant’s portal

Automatic conversion to compatible data for outward clearing

On-Demand reporting based on specific criteria: date, serial number, amount, clearing code, etc

Automatic customer data input from excel file, per individual or company account

Integration with SMARTCHEQUEENTRY™

over-the-counter cheque deposit application to eliminate cheque scanning process at the back-office

OCR Identification to read and convert MICR data into text

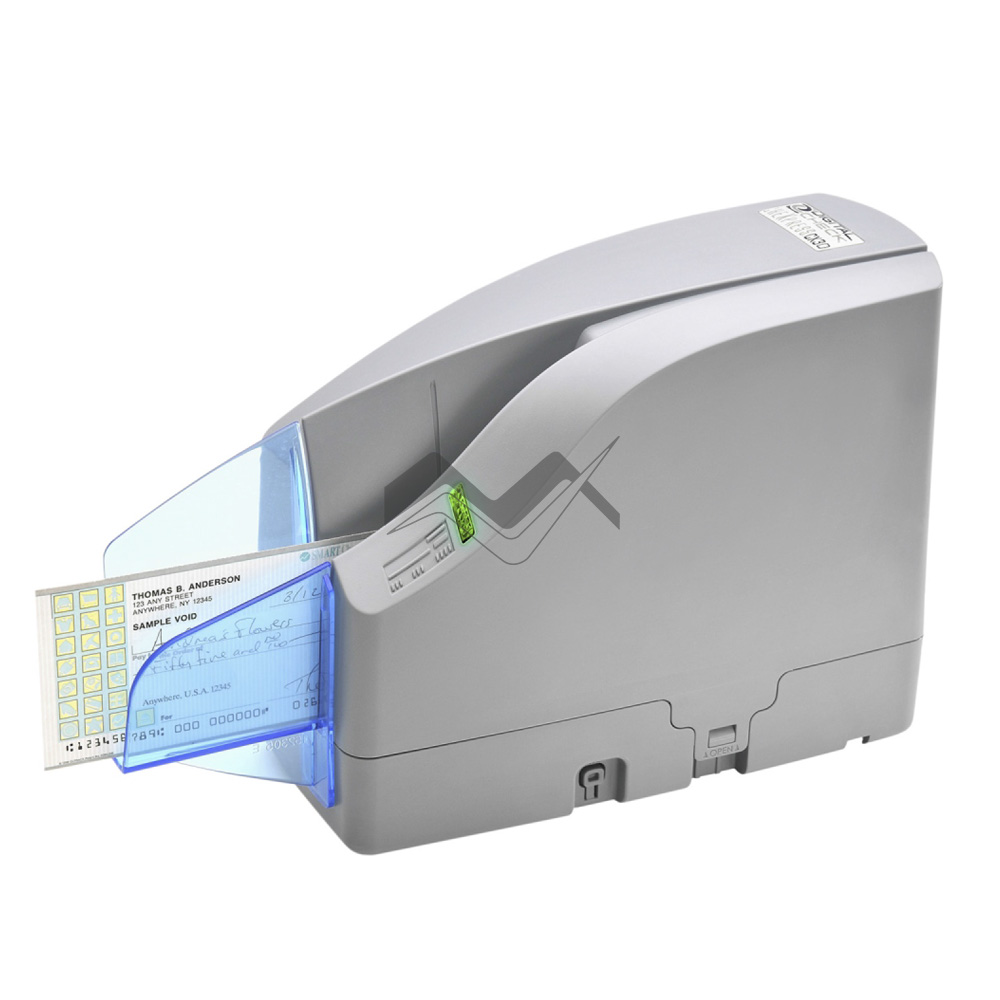

Cost-effective Cheque Scanner

Automatic Cheque Scanner

Automatic Hi-speed Cheque Scanner

Reduced manual process and potential risks with automatic data input

Lower investment cost by eliminating CBS adjustment

Streamlined overall business process with generation of compatible clearing data to SKNBI Gen. 2

Increased security in case of dispute with cheque archival and easy retrieval